Table of Content

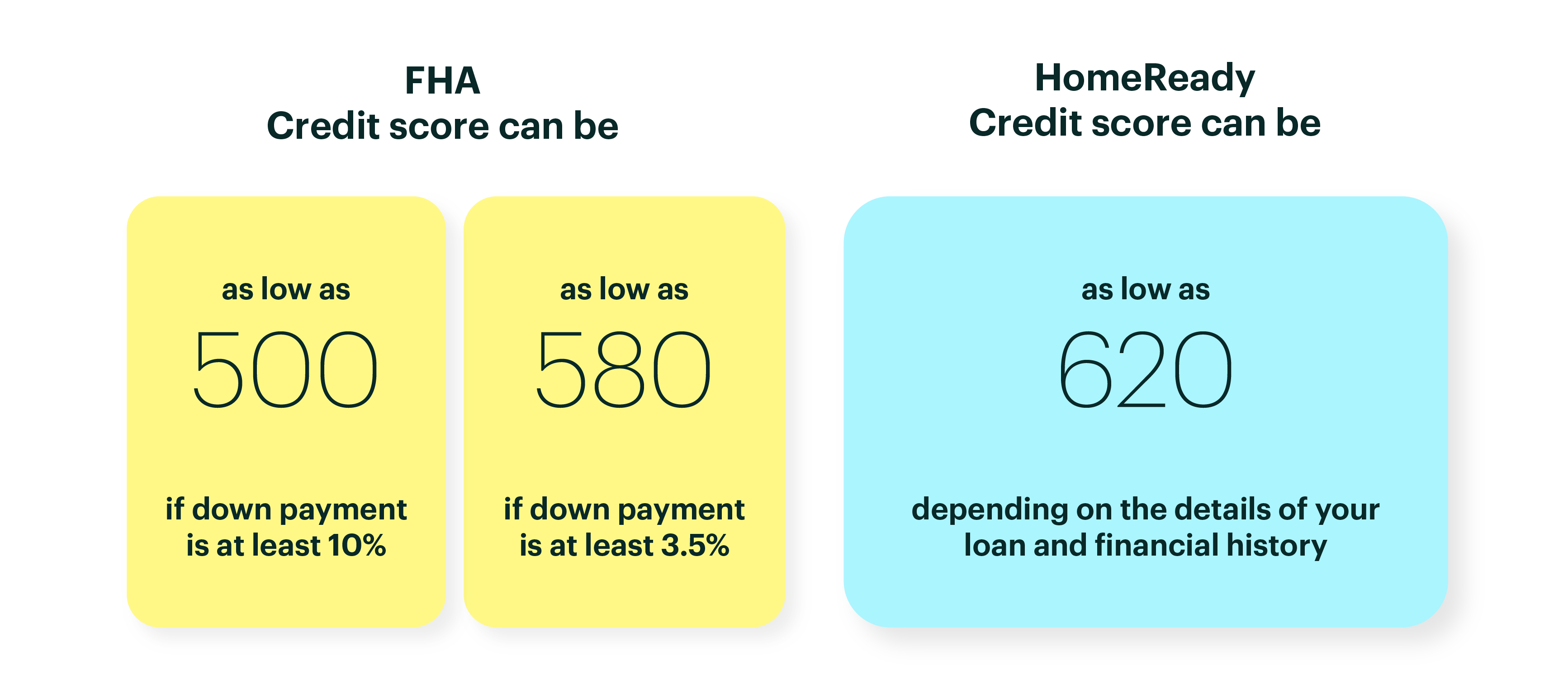

A lot of folks believe there credit scores are worse than they really are. New FHA policy requires a minimum credit of 500 to buy a house. Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offer’s details page using the designation "Sponsored", where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products. No matter what your credit score is, it’s also a good idea to regularly review your credit report for errors and dispute any you find.

Non-prime loans provide an opportunity to get a mortgage for borrowers that do not qualify for conventional and FHA loans. They have much less strict credit requirements, including no waiting periods after bankruptcies, foreclosures, and short sales. Non-prime loans also are available to borrowers with credit scores as low as 500 . This one is always good when you want to improve a low credit score, as it involves establishing a good payment history by paying your bills on time and not missing any payments. A couple of easy tips to improve the score is make sure any credit card balances don’t exceed 60% of the credit line.

Learn more about your credit score

In other words spread your debt around or pay it down so none of your cards exceeds 60%. Start paying the minimum payment plus 20%…it shows you are not a “revolver”…and your score improves. Your score is calculated based on your payment history, the age of your credit accounts, your credit utilization rate, the types of credit you have, and how many new credit accounts you have. You may find that mortgage offers that are available to you come with high interest rates that can cost you a lot of money. It’s important to consider the long-term financial impact of an expensive loan, and it may be worth taking some time to build your credit before applying. If you can’t afford a security deposit, you might be able to find an unsecured credit card.

If your credit could use some work, it’s especially important to shop around to find the best deal for you. Our auto loan calculator can help you estimate your monthly auto loan payment and understand how much interest you might pay based on the rates, terms and loan amount. You can log in to your account to see your personalized Approval Odds for a number of different credit cards. While your Credit Karma Approval Odds aren’t a guarantee that you’ll be approved for a particular card, they can help you find a credit card that matches your current credit profile. It’s a good idea to check your credit reports periodically to make sure there aren’t any errors or mistakes that could be affecting your scores.

How To Get Rid Of Missed Payments On Credit Report

The scores are basically a summation of the way you've handled credit and bill payment. Good credit habits tend to promote higher credit scores, while poor or erratic habits tend to bring lower scores. Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptcies—events that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction. Use this credit dispute letter template to file a dispute with one of the credit bureaus.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. As mention earlier, getting a secured credit card is a great way to establish credit. Secured credit cards work much the same as unsecured credit cards. The only difference is they require a security deposit that also acts as your credit limit. The credit card issuer will keep your deposit if you stop making the minimum payment or can’t pay your credit card balance. Some lenders choose not to lend to borrowers with credit scores in the Fair range.

How Long Does It Take To Get A 597 Credit Score?

Actually opening the account can further hurt your score and have even longer-lasting effects. Repairing your credit is one of the best ways to fix your score, and unlock the happy lifestyle you and your family deserve. USDA loans are only available in rural areas, which includes the outer areas of major cities.

Many prospective home buyers assume that your credit must be in the 600s or 700s to get a mortgage. This is certainly not the case, as many mortgage lenders offer home loans to borrowers with credit scores as low as a 500. In case things get so bad that you are unable to get a personal loan with 310 FICO score or you want another option you can check out, you can go for a payday loan. A payday loan is a short-term loan that requires the personal check of the borrower. The check will be held by the creditor until you have been able to pay back. This can also be done by signing over electronic access to your bank account to receive and repay payday loans.

Get your Credit Score for free

Various lenders have their own personal requirements before they can grant a personal loan request. Generally, it is required that you are 18 years old or above before you can be eligible for a personal loan. It is also required that you have a consistent source of income with credible proof.

Credit builder loans are installment loans that are specifically designed to help people with poor credit build or rebuild credit history. In fact, credit builder loans do not require a credit check at all. Plus, it’s probably the cheapest and easiest way to boost your credit scores. Credit card applicants with a credit score in this range may be required to put down a security deposit.

Some of our articles feature links to our partners, who compensate us when you click them. This may affect the products and services that we showcase in our articles and how we place and order them. It does not affect our evaluations of them, which our writers and editors create independently, without considering our relationships with our partners.

Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan. The minimum credit score required to get a conventional loan is 620. Therefore, you would need to wait until your credit score has increased by at least 23 points before you would be eligible for a conventional loan.

Even with the best auto loans for poor credit, watch out for high interest rates, which can make it very expensive to borrow money. Because secured cards pose less of a risk for credit card issuers, they may be more readily available to someone with poor credit. And a secured card can benefit you as a borrower if the lender reports your on-time payments and other credit activity to the three main credit bureaus.